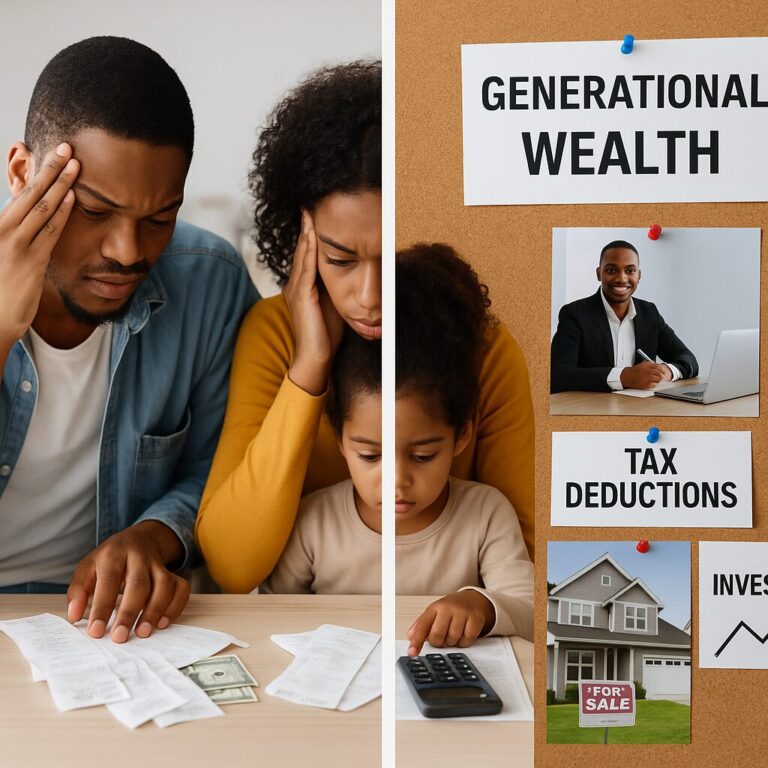

When it comes to wealth in America, the tax code is not neutral — it is designed to reward producers, not consumers. The problem is that too many Black families have been conditioned to live as consumers, not producers. We work, we spend, we pay, but we rarely position ourselves to benefit from the very tax laws that shape the economy. As a result, we are losing not just money — but generational wealth.

The Tax Code Rewards Producers

America’s tax system is structured to encourage business ownership, investment, and wealth creation. Business owners can deduct expenses, investors can benefit from lower capital gains rates, and property owners can write off interest and depreciation. In short, the code is written to benefit those who produce — not those who simply earn and spend.

Consumers Pay the Most

For working families who only collect W-2 wages, there are few breaks. Taxes come out of every paycheck before the money even reaches the household. Meanwhile, the biggest deductions and credits go to entrepreneurs, landlords, and investors. By misunderstanding or ignoring this reality, too many Black families remain stuck in the consumer class — paying full price into a system that others are using to build generational wealth.

The Cost of Misunderstanding

- No Ownership, No Deductions: Without businesses, properties, or investments, families miss out on legal tax strategies that keep wealth in their pockets.

- Spending Instead of Investing: Money flows out on consumption — cars, clothes, entertainment — instead of being positioned in tax-advantaged assets.

- Generational Poverty: Families that never master the tax system never build the kind of transferable wealth that changes future generations.

The Producer’s Mindset

To shift this reality, Black families must begin moving from consumer to producer. That means:

- Starting Businesses — even small enterprises create tax advantages and keep money circulating locally.

- Owning Property — using real estate to benefit from deductions, appreciation, and equity growth.

- Investing Wisely — learning how capital gains, retirement accounts, and dividends can shield and grow income.

- Financial Literacy — teaching our children early that wealth is not about spending but about structuring.

From Surviving to Strategizing

The problem is not simply that we don’t have money. The problem is that we don’t understand how the system works. Black America cannot afford to keep playing the consumer’s role in a producer’s economy.

Every tax season is a reminder: those who misunderstand the code pay the most, while those who master it build the future. If we want to stop losing money, we must stop being passive participants and start positioning ourselves as producers. Because until we do, the tax code will continue to rob Black families of generational wealth.